Communiqué: 88th Meeting of Monetary Council of Eastern Caribbean Central Bank

ECCB - an Institute of the OECS

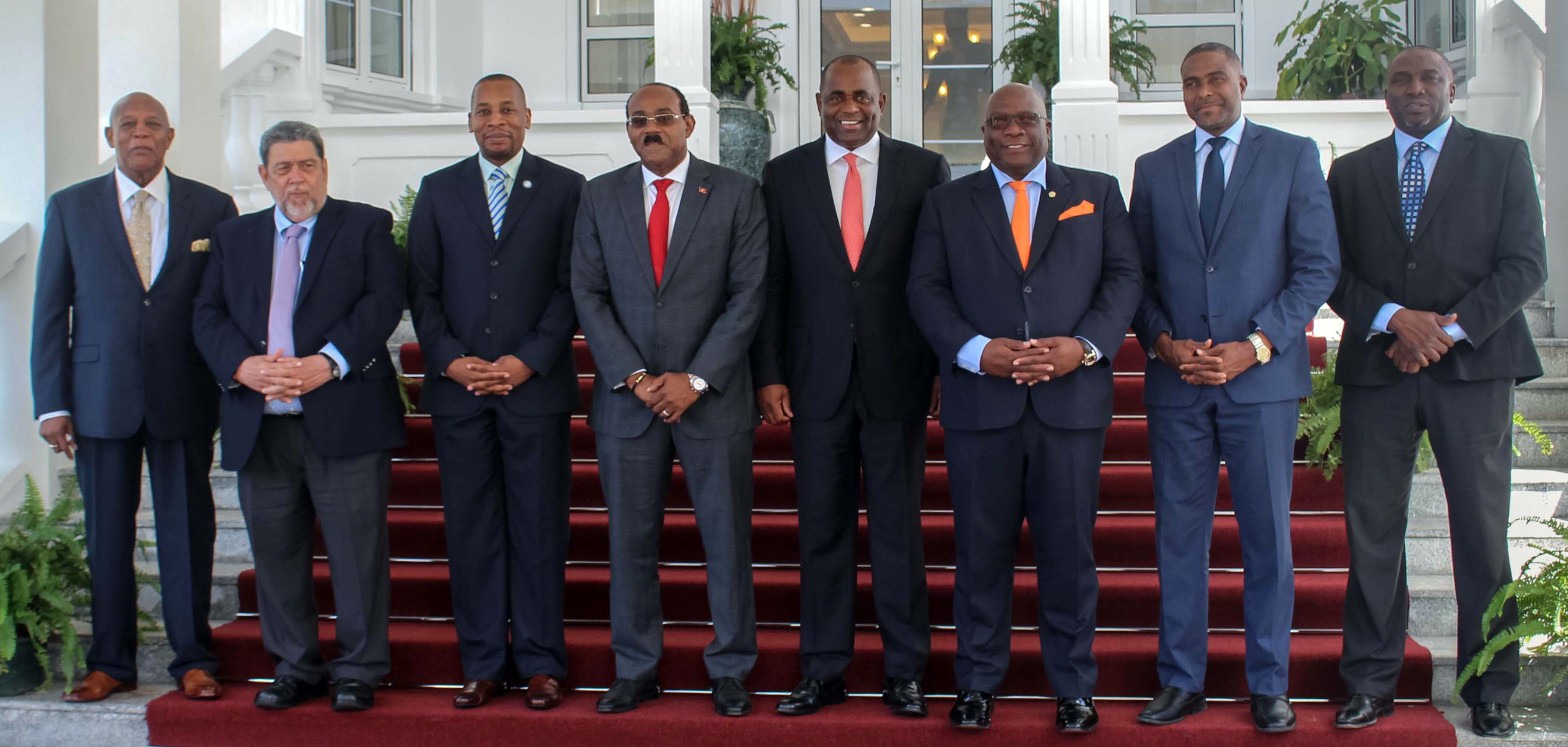

The Eighty-Eighth Meeting of the Monetary Council of the Eastern Caribbean Central Bank (ECCB) was held under the chairmanship of the Honourable Roosevelt Skerrit on 21 July 2017, at the Fort Young Hotel, Roseau, Commonwealth of Dominica.

1.0 Monetary Stability

The Monetary Council received the Governor’s Report on Monetary and Credit Conditions in the Eastern Caribbean Currency Union (ECCU). The report assesses the recent trends in monetary and credit conditions, within the context of the Bank’s broader objectives of ensuring the stability of the exchange rate and exchange arrangements and the stability of the financial system. The key messages from the report were:

- Monetary conditions were assessed to have eased during 2016 as the money supply continued to increase. However, credit conditions tightened, as reflected in the contraction in credit and the widening of commercial banks’ weighted average interest rate spread.

- The exchange rate anchor remained stable and strong throughout 2016, supported by adequate foreign reserves. Exchange rate stability underpins monetary stability, thereby sustaining the confidence necessary for economic activity.

- Consistent with global and regional trends, real output growth in the ECCU stood at 2.6 per cent in 2016, compared with 2.8 per cent in 2015.

Having considered the monetary and credit conditions in the ECCU, the Monetary Council agreed to maintain the minimum savings deposit rate at 2.0 per cent; and maintain the Central Bank’s discount rate at 6.5 per cent. The Minimum Savings Rate is the lowest rate commercial banks can offer on savings deposits. The Central Bank’s Discount Rate is the rate at which the ECCB lends to commercial banks.

2.0 Financial Sector Stability

For the year 2016, the ECCU financial system was assessed as stable. The resilience of the financial system to potential adverse shocks strengthened and major risks to financial stability in the ECCU diminished. However, the banking sector continued to be challenged by structural vulnerabilities, including correspondent banking relationships.

The improved performance of the financial sector is expected to continue into 2017 in line with stronger economic growth and improvements in the regulatory and supervisory framework. Notwithstanding, vigilance must be maintained to ensure that gains are sustainable.

In keeping with its goal of maintaining financial stability, the ECCB would commence publication of a Financial Stability Report annually. The report is aimed at identifying risks and vulnerabilities in the ECCU financial system; assess the resilience of the financial system to domestic and external shocks; and provide information on the soundness of the financial system, and the various initiatives that regulators and governments are pursuing to mitigate risks to the ECCU financial system.

2.1 Recommendations to Address Commercial Banks’ Fees and Charges

Having considered the recommendations from the ECCU Working Group on Commercial Bank Fees and Charges and the ECCU Bankers Association's feedback, Council approved the implementation of the following measures to address concerns regarding increases in commercial banks’ fees and charges:

- The side by side publication of ECCU selected fees and charges for commercial banks’ by territory, on the ECCB’s website no later than January 2018; and

- The issuance of prudential standards on bank fees and charges by December 2018.

3.0 Fiscal and Debt Sustainability

The combined overall surplus on the fiscal operations of ECCU member governments rose to $321.4m at the end of 2016, from $107.8m in 2015. The regional Debt to Gross Domestic Product (GDP), which was 79.3 per cent in 2014, declined to 73.3 per cent in 2015 and 72.5 per cent in 2016.

The fiscal position of member governments is expected to continue to strengthen. Gains are expected in tax and non-tax revenue as economic activity increases and the Citizen by Investment (CBI) programmes investments proceed apace.

At its 87th Meeting, held on 2 March 2017, Council agreed to recommend that member governments submit fiscal targets for the approval. Council therefore agreed to recommend to Member Governments that they implement mechanisms to secure Parliamentary approval of fiscal and debt targets, medium term frameworks as far as practicable with social partners, and for periodic peer review.

4.0 Growth and Competitiveness

The ECCB hosted the inaugural ECCU Growth Dialogue with Social Partners on 1 March 2017. The Dialogue sought to create a unique opportunity for social partners to engage the Monetary Council on the issue of economic growth and to forge consensus on a plan of action for addressing growth, competitiveness and employment in the ECCU. Following the Dialogue the ECCU Growth Action Plan was developed.

In keeping with its commitment to the implementation of the ECCU Growth Action Plan, the Monetary Council:

- Endorsed the collaboration between the OECS Commission and the ECCB on the implementation of an ECCU Growth Action Plan;

- Agreed to recommend that Member Governments appoint a focal point to coordinate the implementation of the Growth Action Plan;

- Agreed to support in country consultations in conjunction with the OECS Commission and the ECCB on the Growth Action Plan.

Council also agreed to urge commercial banks to increase lending to the private sector in an attempt to spur growth. Council noted with increased concern, the difficulties with payment settlement of traders selling agricultural produce in Trinidad and Tobago. Council further noted that the ECCB has submitted a proposal to the Central Bank of Trinidad and Tobago to resolve this issue and expressed the view that a resolution has to be found for this matter. Council urged that this long standing matter be resolved expeditiously. In the meantime, the Council Member for St Vincent and the Grenadines updated the Monetary Council on a solution that his government is advancing.

5.0 Legislative Reforms

5.1 Proposed Areas of Amendment to the Banking Act 2015

At its 86th Meeting held on 21 October 2016, the Monetary Council approved the establishment of a Ministerial Subcommittee of the Council, chaired by the Council Member for St Vincent and the Grenadines, to lead discussions with stakeholders on the proposed amendments to the Act and to facilitate the process through to its enactment.

To this end, a Consultative and Legislative Drafting Workshop was held on 11 April 2017 in St Vincent and the Grenadines. ECCU Attorneys General, Parliamentary Counsel, Financial Secretaries and other representatives of the Ministries for Finance, representatives of the ECCU Bankers’ Association, local Bankers Associations, and representatives of the ECCB attended the workshop. The team discussed the policy issues related to the amendments and the concerns of the banking industry and reached consensus on the draft amendments.

The Monetary Council approved the amendments to the Banking Act 2015; and agreed to urge Member Governments to secure passage of the amendments to the Banking Act 2015 by 31 December 2017.

5.2 Amendments to the AML/CFT Legislation

At its 85th meeting held on 22 July 2016, Council took the decision to recommend to Member Governments that the legal responsibility for Anti-Money Laundering and Counter Financing of Terrorism (AML/CFT) supervision and regulation of financial institutions licensed under the Banking Act be transferred to the ECCB.

The Monetary Council therefore considered the proposed areas of amendment to the Anti-Money Laundering and Counter Financing of Terrorism Legislation (AML/CFT legislation) in Anguilla, Antigua and Barbuda, Commonwealth of Dominica, Grenada, Montserrat, St Kitts and Nevis, and Saint Lucia, to transfer the regulatory and supervisory authority of AML/CFT for institutions licensed under the Banking Act to the ECCB.

6.0 Report From the Technical Core Committee on Insurance - BAICO

Council noted that the Plan of Arrangement (BAICO and CLICO) Act has been passed in all ECCU member countries and in the home jurisdiction of The Bahamas. Council further noted that once the agreements of the respective Courts are received, this would pave the way for the meeting of the creditors and a distribution to BAICO policy holders in the last quarter of 2017.

With respect to CLICO, progress has been markedly slower and resolution is a greater challenge. The Technical Core Committee is exploring a number of options to have the issues relating to the CLICO policy holders addressed effectively.

7.0 Acknowledgement

Council thanked Mr Maurice Edwards for his 28 years of unbroken service to the ECCB Board of Directors since 1990 in his various capacities including, Chairman of the ECCB Board Audit and Risk Committee. Mr Edwards demitted office as a member of the ECCB Board of Directors at the end of 30 June 2017.

8.0 Date and Venue of 89th Meeting of the Monetary Council

Council agreed that the 89th Meeting of the Monetary Council would convene on Friday, 20 October 2017 via videoconference.

9.0 Attendance

Council Members attending the meeting were:

- Hon Roosevelt Skerrit, Prime Minister and Minister for Finance, Commonwealth of Dominica (Chairman);

- Hon Victor F Banks, Chief Minister and Minister for Finance, Anguilla;

- Hon Gaston Browne, Prime Minister and Minister for Finance, Antigua and Barbuda;

- Hon Donaldson Romeo, Premier and Minister for Finance, Montserrat;

- Dr the Hon Timothy Harris, Prime Minister and Minister for Finance, St Kitts and Nevis;

- Dr the Hon Ralph E Gonsalves, Prime Minister and Minister for Finance, St Vincent and the Grenadines; and

- Hon Ubaldus Raymond, Council Alternate for Saint Lucia.